ISO FURRIERS CUSTOMERS COVERAGE FORM ANALYSIS

(April 2024)

|

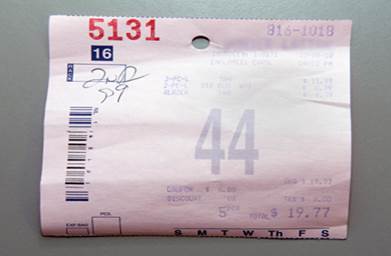

IH DS 63–Furriers Customers Declarations |

INTRODUCTION

The Insurance Services Office (ISO) Furriers Customers Coverage Form insures the property of customers while in the care, custody, or control of a named insured that accepts furs, fur garments, and fur-trimmed garments for storage, alteration, repair, remodeling, or cleaning. Operations that might purchase this coverage are furriers (or fur dealers), department stores, fur or general warehouse operations, and cold storage operations.

Coverage applies only if the named insured issues a receipt for the property it receives that contains the agreement between it and the customer for any article placed in its control. The receipt must describe the article and provide a value establishing the named insured's maximum liability for loss to the garment. The form can also be used to cover property of customers of other bailees, property away from the named insured's premises, and property during pick-up and delivery. Coverage is similar to Bailees Customers coverage in that it applies only to cases where the bailment is for the mutual benefit of both the customer that owns the property and the bailee that stores or services the property.

Related Articles:

AAIS Bailee Customers Floater Coverage–Dry Cleaners and Laundry Form

AAIS Bailee Customers Floater Coverage–Processor Floater

ISO Bailees Customers Coverage Form

POLICY CONSTRUCTION

Furriers Customers Coverage requires at least the following six forms:

- IL DS 00–Common Policy Declarations

- IL 00 17–Common Policy Conditions

Related Article: IL 00 17–Common

Policy Conditions Analysis

- CM DS 02–Commercial Inland Marine Declarations

- CM 00 01–Commercial Inland Marine Conditions

Related Article: CM 00 01–Commercial Inland Marine Conditions

- IH DS 63–Furriers Customers Declarations

- IH 00 63–Furriers Customers Coverage Form

IH DS 63–FURRIERS CUSTOMERS DECLARATIONS

The advisory Furriers Block Declarations does not have spaces for the named insured, its mailing address, other named insured information, the policy period, or the description of the insured business. That information is on the Common Policy Declarations. IH DS 64 contains the following information:

Insurance Company and Producer Name

The name of the insurance company that provides the coverage and the name of the agent or broker that produces the business are entered in the spaces provided.

Limits of Insurance

This section has spaces to enter the following:

- Addresses of storage locations. Limits are to be provided for the following:

- In Storage Enclosures

- Outside of Storage Enclosures

Note: These locations may be owned or nonowned locations

- Addresses and limits of insurance for the named insured's locations that are Not Used For Storage

- Limits of insurance for Property at Any One Unnamed Premises

- Limits of insurance for Property in Transit

- Optional Coverages are available. Only the following coverage with a limit entered apply:

- Excess Legal Liability–Property of Your Customers Any One Garment Limit and Any One Occurrence Limit

Note: If a limit is entered IH 63 02–Excess Legal Liability Coverage endorsement must be attached.

- Excess Legal Liability–Property of Customers of Other Bailees–Any One Garment Limit and Any One Occurrence Limit

Note: If a limit is entered IH 63 02–Excess Legal Liability Coverage endorsement must be attached.

- Accrued Storage and Service Charges

Note: If a limit is entered IH 6303–Accrued Storage and Service Charges endorsement must be attached.

- Limits of insurance for All Covered Property in Any One Occurrence

Note: This is a catastrophic limit that applies over all of the coverages described above. If any of the above limits are changed, this limit should be evaluated for potential change.

Deductible

This section has a space to enter the amount of deductible that applies.

Rates and Premiums

The following is entered when coverage is written on a non-reporting basis:

- Rate per $100

- Premium

The following is entered when coverage is written on a reporting basis:

- Rate per $100

- Deposit Premium

- Minimum Premium

- Reporting Period

- Premium Adjustment Period

- Premium Base

- Total Premium

Special Provisions

Any special provisions are entered in the space provided.

IH 00 63–FURRIERS CUSTOMERS COVERAGE FORM ANALYSIS

This analysis is of the 12 13 edition. Changes from the previous edition are in bold print.

Introduction

This section encourages carefully

reading the entire coverage form to determine what is covered, what is not

covered, rights, and duties. It defines we, us, and our as the insurance company that provides this insurance

coverage. It also defines you and your as the named insured on the

declarations. The reader is also pointed to the Definitions section because

certain words or terms used in the form have a broader or restricted meaning.

A. Coverage

The insurance company pays for direct physical loss or damage to covered property but only when that loss is from a covered cause of loss.

1. Covered Property

a. The personal property of the named insured's customers for which a receipt has been issued by the named insured is covered. This covered personal property is limited to furs, fur garments, and fur-trimmed garments that have been accepted by the named insured for storage, alteration, repair, cleaning, or remodeling and other garments and similar items that the named insured has accepted for storage.

b. This property must be either in the named insured’s care, custody, or control or in storage at a location listed on the declarations.

Note: It is important to understand that the items at the storage location are not required to be in the named insured’s care, custody, or control. This means the storage facility can be a non-owned facility operated by a third party.

2. Property Not Covered

The following property is not covered:

a. Property the named insured, its officers, directors, employees, agents, messengers, members or managers of limited liability companies own. Property of family members, relatives, or friends of any of these is also not covered.

Note: The use of the term friend makes this very difficult to interpret. Friendship is a very subjective term that does not belong in an insurance contract. Similarly, the term relative is difficult because it is not limited. Therefore, if a claims adjuster determined that the fur being stored was owned by a seventh cousin of an employee could coverage be denied? Would the named insured need to specify on the receipt that it is not responsible for damage to the goods of any such relative?

|

Example: Jacklyn entrusts her full-length

fur with Andrew’s Fur Specialists for repair and storage. Jacklyn is the aunt

of Peggy, an administrative assistant to Andrew. When Jacklyn’s fur is

damaged, her claim is denied because Peggy is her niece. |

b. Property that bailees do not customarily accept for storage is not covered. Examples of such bailees are furriers, cleaners, laundries, department stores and warehouses.

Note: This is a very ambiguous property not covered item that would be very difficult to defend.

c. Contraband. Any property that is illegal for the named insured to own or in illegal trade or transportation is not covered.

3. Covered Causes of Loss

Covered causes of loss are direct physical loss or damage to covered property with the exception of causes of loss listed in the exclusions section.

4. Additional Coverages

Some of the following additional coverages are in addition to the limits of insurance.

a.

Misidentification of Property

This additional coverage does not increase the limit of insurance.

|

|

Example: A fire at Frank’s Furs main location destroys all the storage receipts. The furs were stored at another location and were unharmed. Amanda brings a receipt and demands her coat, but Frank cannot verify its accuracy. He takes her to the storage facility and allows her to select her coat. Later, Penelope arrives with a receipt and is also allowed to find her coat. She cannot find it. Penelope brings a picture of the coat to Frank. He then realizes it is the coat that Amanda took. Frank cannot find a record of Amanda. There is coverage for the lost coat because the loss is due to misidentification resulting from a covered cause of loss. |

b. Debris Removal

A property damage loss usually creates

debris that must be removed. The insurance company pays the cost of removing

the debris of a covered loss. The expenses must be reported to the insurance

company in writing within 180 days of the date of loss. The most paid is 25% of

the sum of the following:

- The amount that is paid for direct

physical loss or damage to covered property

- The deductible that applies to such

direct physical loss or damage

Payments under this Additional Coverage do

not increase the limit of insurance that applies. However, the insurance

company pays an additional $5,000 per occurrence when the direct physical loss

or damage combined with the debris removal expense exceeds the limit of

insurance or when the debris removal expense is more than the amount payable

under the above described 25% limitation.

This coverage does not apply to costs to

extract pollutants from land or water or to remove, restore, or replace

polluted land or water.

c. Pollutant Clean Up and Removal

The insurance company pays to clean up

pollutants caused by or that result from a covered cause of loss that occurs

during the policy period. The most paid is $10,000 as an aggregate amount

during each separate 12-month policy period. The expenses are paid only if they

are reported to the insurance company in writing within 180 days of the date of

loss.

This coverage does not apply to costs to

evaluate the presence or effects of pollutants. However, it does pay for

testing that is part of the process of extracting pollutants from either land

or water.

This limit is an additional amount of insurance.

d. Preservation of Property

Covered property may need to be moved to keep it from being damaged by a covered cause of loss. When the named insured takes such action, the insurance company pays for any direct loss or damage that such property sustains during the move. In addition, coverage applies at the location where the property is stored for up to 30 days after the date it was moved there.

The property removed must be moved back to the covered location, or the temporary location must be added to the policy within 30 days from the date of the move. Otherwise, all coverage ends after 30 days.

This additional coverage does not increase the limit of insurance.

Notes: There are several important points to consider:

- The potential loss or damage from which the property is being protected must be a covered cause of loss.

- Covered property is covered for ANY cause of loss while it is being moved to and from (and while at) the "safe" location.

- The property removed must be moved back within 30 days from the date of the move.

e. Supplementary Payments

Note:

These payments are common

in liability coverage forms but not property coverage forms. As with liability

coverage forms, many costs are incurred in handling, settling, defending, and

adjusting claims. This Additional Coverage describes which costs are paid and

any limits applied to them.

The insurance company pays the following

charges only when they are a part of a claim investigation or settlement. It

also pays the charges for any suit that it defends. All payments are in

addition to the limits of insurance that apply and do not reduce the limit of

insurance available to pay for the claim.

- All expenses

the insurance company incurs

- Costs of

appeal bonds and bonds required to release attachments. These costs are

paid for only bond amounts up to the

limit of insurance that applies to the coverage. The named insured pays

the costs of such bonds that are in excess of the insurance company paid

bonds. The insurance company is not required to furnish these bonds.

- Expenses the

named insured incurs at the insurance company’s request for it to

investigate or defend a claim or suit. One of these expenses is the actual

loss of earnings because of time off from work, up to $250 per day.

- All suit

costs that are taxed against the named insured

- Prejudgment

interest that is awarded against the named insured but only for the

interest based on the part of a judgment the insurance company pays. This

applies to only prejudgment interest earned prior to the insurance

company’s offer to pay the limit of insurance that applies.

- All interest

on the full amount of any judgment that accrues after a judgment is

entered. This ends when the insurance company pays, offers to pay, or

deposits with the court the part of the judgment within this coverage’s

limit of insurance.

Note:

This means that the

insurance company must pay interest on its part of the judgment and all other

parties’ part of the judgment before it pays the amount required. Once this

insurance pays, any interest that accrues on the remainder of the judgment becomes the responsibility of those

other parties.

B. Exclusions

1. Primary Exclusions

The first group of exclusions applies

whether or not the loss event results in widespread damage or affects a

significant geographical area and is essentially absolute. Subject to specific

exceptions, each is totally excluded, regardless of any other cause or event contributing

to a loss, concurrently or in any other sequence. The insurance company does

not pay for any direct or indirect loss or damage caused by or that results

from any of these events.

a. Earthquake

This exclusion does not exclude earth

movement. It excludes ONLY earthquake. There

is one exception. If the earthquake starts a fire, the loss or damage caused by the fire is covered. Coverage applies

only if this insurance covers that fire.

b. Governmental Action

This exclusion applies to the legal and

authorized seizure or destruction of property by a government entity’s order.

There is one exception. Loss or damage that is caused when the governmental

entity orders property to be destroyed is covered if used as a method to

prevent a fire from spreading is covered. However, this exception applies only

if the fire being contained would have

been a covered fire under this coverage form.

c. Nuclear Hazard

Nuclear reaction, radiation, or radioactive

contamination is not covered. There is an exception. If a fire results from the nuclear reaction, radiation, or

radioactive contamination there is coverage for the direct loss or damage

caused by that fire.

d. War and Military Action

This exclusion lists three specific warlike activities.

- War. This can be a declared war, an undeclared war, or a civil war.

- Military force of a warlike nature. These activities must utilize military personnel or agents of a government or other type of authority. Actions taken to prevent any of these activities are also considered war.

- Insurrection, rebellion, revolution, and attempts to usurp power. Any action a government takes to respond to such actions is also considered war.

e. Water

Water is flood,

surface water, waves, tidal water, tidal waves, tsunami, overflow of any body

of water, or their spray, all whether wind

driven or not. It also includes storm surge. Loss or damage from waterborne material that any of this water

described in the first sentence moves or carries is also excluded.

This exclusion applies even if an act of

nature or another event causes any of the above.

There is an exception. If any activity of

water described above results in fire, explosion, or theft, coverage applies for the loss or damage that fire, explosion, or

theft causes. This applies only if the coverage form otherwise covers the fire,

explosion, or theft.

2. Secondary Exclusions

The second group of exclusions applies to

loss or damage caused by or resulting from any of the following loss events.

Some of these exclusions have exceptions, conditions, or limitations that

should be noted and reviewed carefully. The insurance company does not pay for

any loss or damage caused by or resulting from any of these events.

a. Theft from an unattended vehicle

This is loss

due to theft from an unattended vehicle. There are two exceptions.

- If the vehicle's doors, windows, and

compartments were closed and locked at the time of the theft and visible

signs of forced entry are present, the loss is covered.

- Covered property in a carrier for

hire’s care, custody, or control is not subject to this exclusion.

b. Delay, loss of use, and loss of market

These are consequential or indirect losses

that develop as a result of a direct loss or damage.

c.

Unexplained disappearance

When covered property is gone and there is

no obvious cause or explanation of what happened to it.

d.

Shortage found upon taking inventory

Any loss discovered as a result of an

inventory shortage and there is no explanation as to what happened to the

property, similar to unexplained

disappearance. This is sometimes referred to as "inventory

shrinkage."

e.

Dishonest or criminal acts (12 13

changes)

These are any dishonest or criminal acts the

named insured, its partners, employees,

temporary employees, leased workers, officers, directors, trustees,

authorized representatives, or members and managers of a limited liability

company commit. This also includes

theft.

Such acts committed by anyone with an

interest in the property, their employees,

temporary employees, leased workers, or authorized representatives who act

alone or who act in collusion with other parties or with each other are also

excluded. This exclusion also applies whether or not the acts take place during

regular working hours.

This

exclusion does not apply to acts of destruction by the named insured’s

employees, temporary employees, leased workers, or authorized representatives.

However, there is no coverage for theft by the named insured’s employees,

temporary employees, leased workers, or authorized representatives.

The

12 13 edition removed the part of the exclusion in the previous edition that

applied to dishonest or criminal acts committed by anyone entrusted with the

property for any reason.

f.

Pollution

There is no coverage for loss caused by or that

results from any release, discharge, seepage, migration, dispersal, or escape

of pollutants. There are two exceptions:

- A specified cause of

loss causes the event

- When a pollutant event results in a specified

peril, the resulting loss from that specified cause of loss to covered

property is covered.

Note: Section F. Definitions 2. Specified Causes of Loss lists the covered causes of

loss that apply to the exception for this exclusion.

g.

Processing or work upon the property

Loss or damage caused when covered property

is being processed or worked upon is not covered. This applies regardless of

who is doing the processing. There is one exception. If a fire or explosion

results from such work or processing of covered property any damage to covered

property caused by that fire and explosion,

is covered but only if the fire or explosion is otherwise covered under this

form.

h. Liability assumed under any agreement

Liability that the named insured assumes under any

agreement that does either of the following is excluded:

- Guarantees processing or work on

covered property results

- To find and provide insurance for

covered property regardless of the type or amount of the coverage. The one

exception is the coverage being provided by this policy.

|

Example: An agent specializing in personal inland

marine coverage approached Andrews to help him provide fur coverage for

Andrews’s customers under a master policy. Andrews agreed, and eventually, all

the customers had transferred their fur coverage to this master policy. Any

claims or suits arising from Andrews’s involvement with this insurance

arrangement are excluded. |

i. Voluntary parting

When covered property is transferred to

another person or place because unauthorized instructions were received to do

so.

j. Unauthorized instructions

When covered property is transferred to

another person or place because unauthorized instructions were received to do

so.

k. Neglect

Neglect on an insured’s part to take

reasonable measures to preserve and protect covered property from subsequent

damage during and after the time of loss.

l. Cost to research

All costs to research, replace, or restore

converted data, programs, or instructions used in any data processing

operations. The cost of the materials on which the data is recorded is also

excluded.

Note:

This appears to be out of

place for this particular coverage.

m.

Theft (12 13 addition)

Theft

by any person the named insured entrusts covered property to for any reason,

whether they act alone or in collusion with any other party. This exclusion

applies 24 hours a day/7 days a week. There is one exception. Covered property in a carrier for hire’s care, custody, or

control is not subject to this exclusion.

3. Other Exclusions

This group of exclusions applies to loss or damage caused by or resulting

from any of the following loss events. In every case, if loss or damage by a

covered cause of loss occurs as a result of one of these excluded events,

coverage applies to the loss or damage the resulting covered cause of loss causes. The insurance company does not pay

for any loss or damage caused by or that results from any of these events.

a.

Weather conditions

This is loss or damage to covered property

that weather conditions cause. This exclusion applies only if the weather

conditions contribute in any way to a cause or event that involves the

following 1. Primary Exclusions to produce the loss or damage:

·

a.

Earthquake

·

b.

Governmental Action

·

c.

Nuclear Hazard

·

d. War

and Military Action

·

e.

Water

b. Acts

or decisions

Acts or decisions any person, group,

organization, or government entity makes that result in loss or damage. Failing

to act or to make decisions is also excluded.

c.

Wear and tear

This is loss or damage due to wear and tear.

Note:

Wear and tear is damage

that occurs naturally as a result of aging or normal wear.

d.

Any quality in the property

These are any qualities in the property that

cause it to destroy or damage itself.

Note:

An example is a loss or damage caused by hidden or latent

defects in the property.

e.

Mechanical breakdown

This is loss or damage caused by or that

results from machines, tools, or mechanisms failing to operate or function

properly.

f.

Insects, vermin, or rodents

This is loss or damage to covered property

caused by or that results from insects, vermin, or rodents.

Note:

Some examples are damage

from mice, rats, cockroaches, squirrels, beavers, spiders, ants, centipedes,

and ticks. Each is characterized by destructive habits that cause damage, such

as gnawing and nibbling.

C. Limits of Insurance

The most the insurance company pays for each item of covered property is

the amount on the customer receipt for it.

The most paid for loss or damage in a single occurrence is the limit of

insurance on the declarations for the applicable coverage.

D. Deductible

The insurance company does not pay for loss or damage until the amount of the adjusted loss or damage (before capping with the limit of insurance that applies) exceeds the deductible on the declarations. It then pays the amount of the adjusted loss or damage that exceeds the deductible up to the applicable limit of insurance.

E. Additional Conditions

1. Valuation

This condition replaces the Valuation General Condition in the Commercial Inland Marine Conditions.

The value of lost or damaged property is its value when the loss or damage occurs. Whatever determination is made to the valuation below, the value of the named insured's labor, material, or services furnished or arranged prior to the loss is added to it.

The value of each damaged article is the least of the following:

- The amount recorded on the customer receipt that applies to the item

- Its actual cash value

- Reasonable costs to restore the article to the condition that existed just before the loss occurred

- The cost to replace the article that sustained loss or damage with very similar or identical property

2. Other Conditions

These conditions apply in addition to the Commercial Inland Marine Conditions and the Common Policy Conditions.

a. Receipts

The insurance company does not establish the receipt that must be used by the named insured; however, it does require the customer receipt states that the customer accepts the receipt as correct unless notification is made to the named insured within ten days of the date it was issued. Each receipt is required to state the value of the covered property to which it applies. That value on the receipt becomes that article’s limit of insurance.

Except for temporary or interim receipts, these receipts do the following:

· Are for the benefit of the insurance and the named insured on an equal legal basis.

· Are not permitted to extend this policy’s limits of insurance or its provisions.

· When a temporary or interim receipt had been issued, the permanent one supersedes that other receipt in its entirety.

b. Coverage Territory

The coverage territory is the United States

of America, its territories and possessions, Puerto Rico, and Canada. This

includes property that is shipped by air within and between these points.

c.

Protective Safeguards

If the named insured states in the

application that a protective safeguard is in place at a premises, that protective safeguard must be maintained and

operational whenever the premise is not

open for business.

If that safeguard is not operational when

the premise is closed, all coverage at

the premises is suspended until it becomes operational again.

Note: This is a very important warranty that

removes all coverage, regardless of the cause

of loss, when the protective safeguard goes down. There are no exceptions.

|

Example:

The lines for the burglar

alarm system to the central station at Andrews Furs are nibbled through,

triggering the central station alarm. When the problem is diagnosed, Andrews

is not sure he wants to stay with the same system. He hires a security

company to keep the facility under surveillance as he researches other

installations. The next day, a vehicle plows through Andrews’s building,

damaging several furs that were out of the storage vault waiting to be worked

on. Andrews is quite surprised to discover that the vehicle damage loss is

not covered because all coverage was suspended as soon as he was aware that

the alarm was not operational. |

d. Records and Inventory

The named insured must accurately maintain records

of all receipts that it issues and to keep them for at least three years after

the policy expires. The record for each receipt issued must include the

following:

- The customer’s name and address

- The property’s description

- The property’s value. This is based on

the customer’s stated value only.

- The property’s location

e. Changes to Premises

Coverage does not apply to property where

the risk of loss or damage materially increases by changes at the location or

to property that is situated in expansions of the location listed on the

declarations unless the insurance company has provided written permission.

F. Definitions

There are four definitions.

1. Pollutants

These are any solid, liquid, gaseous, or

thermal irritants or contaminants. Pollutants also include smoke, vapor, soot,

fumes, acids, alkalis, chemicals, or waste. Waste is any material intended to

be recycled, reconditioned, or reclaimed.

2. Specified causes of loss

The named perils of fire, lightning, explosion, windstorm, hail, smoke,

aircraft, vehicles, riot, civil commotion, vandalism, leakage from fire

extinguishing equipment, sinkhole collapse, volcanic action, falling objects, weight of ice, sleet, or snow and water damage.

Two terms need further explanation:

- Sinkhole collapse is the

earth’s surface suddenly settling or collapsing into an underground

opening created by water acting on limestone or some other rock formation.

It does not include either the cost to fill sinkholes or the land that

collapses or sinks into the

voids.

- Falling objects does not include loss to personal property stored

in the open. It also covers damage to the interior of buildings or

personal property that is stored in buildings by a falling object only if

a falling object first breaches the building's exterior.

3. Suit

A civil action or legal proceeding that

alleges damages because of property damage to covered property. Arbitration

proceedings claiming such damages and any other alternative dispute resolution

proceedings are also considered suit but only if the named insured is required

to submit to them or it receives permission from the insurance company to

submit to them.

4. Water damage

Water damage occurs when part of a system of appliance holding water or

steam cracks or breaks, resulting in an accidental discharge or leakage of

water or steam.

ENDORSEMENTS

ISO has developed one proposal form and two specific endorsements to use with the Furriers Customers Coverage Form.

IH 63

01–Proposal for Furriers Customers Coverage Form

This is the application for furriers customers coverage. Each part must be completed in full and be signed by the named insured. A separate proposal is required for each covered location.

IH 63

02–Excess Legal Liability Coverage

Excess legal liability coverage is provided for amounts that exceed the amounts stated in customer receipts. A per item limit and per occurrence limit must be entered on the declarations when this endorsement is attached.

IH 63

03–Accrued Storage and Service Charges

Accrued storage and service charges that are unpaid and uncollectible and prepaid charges that must be refunded to customers are covered when this endorsement is attached. A limit of insurance must be entered on the declarations for this coverage.

ISO has developed one other endorsement that can be used with this policy to respond to a specific situation.

IH 99 11–Gross Receipts Reporting Form

This endorsement can be used to convert the coverage to a daily, weekly, monthly, quarterly or policy year reporting form.

UNDERWRITING CONSIDERATIONS

Underwriting Furriers Customers coverage involves evaluating many physical factors because most furriers are at fixed locations and are subject to common fixed location causes of loss. They are difficult to underwrite because the covered property is susceptible to damage by fire, smoke, water, burglary, and theft. Large losses may occur because the furrier can be held liable for the full value of the garment in certain cases, even if the customer receipt reflected a lower value. As a result, the primary underwriting considerations are location and transit issues, protective devices and services, and management.

Location factors to consider include the exposure to losses by fire. This involves evaluating the building construction, the exact nature of the occupancy, exposing occupancies, and public and private fire protection. Central station fire alarms are desirable. Furs not being processed or worked on should be kept in vaults to reduce the chance of smoke damage and to reduce the spread of fire. Exposures may be an issue, especially in shopping centers and malls. If the risk is equipped with automatic sprinklers, storage and display arrangements should be evaluated, and stock particularly susceptible to water damage should be located away from it and protected some other way. Water damage can be reduced or eliminated by having furs stored on shelves in some cases instead of simply on hangers in the open. Risks should be at or above grade level and appropriate measures, such as floor drains and liquid-tight doorsills, used to reduce water damage. Employees should be trained to remove garments in the event of a fire. A proper number of fire extinguishers should be available and properly placed throughout the premises. Earthquake issues may be present in certain geographical areas, and the building design and construction must be considered.

Burglary is a critical issue. The premises should always be protected by an excellent quality alarm system that covers all exterior openings and connects to a certified central station alarm facility. Theft and mysterious disappearance are common issues for this class of business. The premises should be equipped with video surveillance and recording equipment, indoor and outdoor security lighting, motion detectors, and steel bars on windows. Hold-up alarms and watchperson service should be considered. Access to storage rooms should be limited, and they should be locked when not in use. Arrangements and procedures that address storage and various processing issues should be in place. The same procedures should apply to property at other locations, exhibits, and trade shows. Background checks should be done on all persons before they are hired.

Transit exposures should be addressed using many different modes of transportation, varying the pattern and frequency of trips and keeping values shipped as low as possible. Owned vehicles used to transport covered property should be equipped with alarms. Strict accounting and sign-off procedures should be incorporated, and carriers for hire should be evaluated to be certain they are experienced, qualified, and up to the task.

Ownership and management issues may be the most important of all. The named insured's financial condition dictates the degree of attention to protective devices and procedures incorporated into the business. Its experience in the business and hiring practices are other essential elements to consider and evaluate. Developing and implementing plans, procedures, protocols, and actions to take in an emergency before they are needed are other critical factors. There should be procedures for hiring, bonding, emergencies, opening and closing the premises, locking and unlocking storage enclosures, testing alarms, and handling customer property. Maintenance and care of the premises and protective devices also affect the overall desirability and success of a business that handles customers’ furs.